$12 an hour is $480 a week before taxes and deductions, assuming a standard 40-hour workweek. However, calculating your actual take-home pay requires a more detailed approach. This guide provides a step-by-step process for accurate calculation, highlights the limitations of online calculators, and offers tips for responsible financial management.

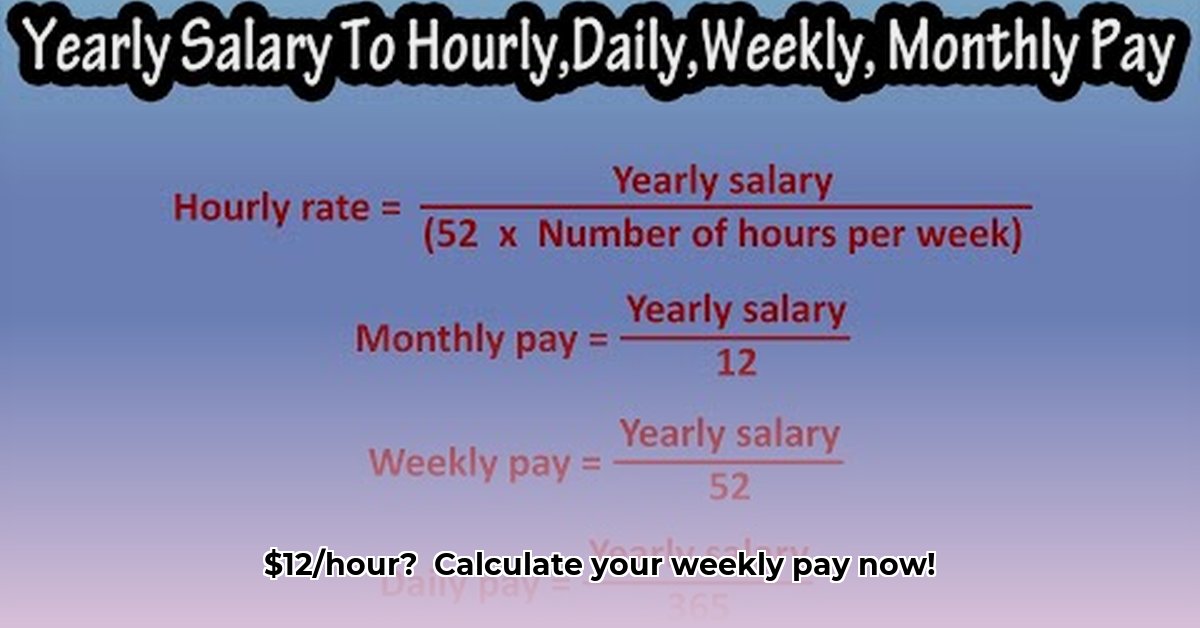

How to Calculate Weekly Earnings

Calculating your weekly earnings is straightforward, but accuracy demands attention to detail. Here’s how:

Determine Your Hourly Rate: This is your base pay. In our example, it's $12 per hour.

Calculate Regular Weekly Pay: Multiply your hourly rate by your regular weekly hours. For a 40-hour week, this is $12/hour * 40 hours = $480 (Gross Pay).

Factor in Overtime (if applicable): Many jobs offer overtime pay for hours exceeding the standard workweek. This is usually 1.5 times your regular rate (time and a half). For instance, if you worked 5 overtime hours, your overtime pay would be (1.5 * $12/hour) * 5 hours = $90.

Calculate Gross Weekly Pay: Add your regular pay and overtime pay together. In our example (including overtime), gross pay is $480 + $90 = $570.

Understand Gross vs. Net Pay: Your gross pay is your earnings before taxes and other deductions. Your net pay (take-home pay) is considerably lower. Online calculators frequently overlook this important distinction.

Limitations of Online Calculators

While convenient, online pay calculators have significant limitations:

Variable Work Hours: Many calculators assume a consistent 40-hour workweek, ignoring the reality of fluctuating schedules. Inconsistent hours will result in inaccurate calculations.

Location-Specific Minimum Wage: Minimum wage laws vary by location. A generic calculator may fail to account for your specific region's minimum wage requirements.

Tax and Deduction Omissions: This is the most critical limitation. Most online calculators don't account for federal, state, and local taxes, social security, Medicare, or other deductions, leading to significantly inflated results. This can lead to inaccurate budgeting and financial planning.

Using Online Calculators Effectively

To utilize online calculators responsibly:

Compare Results: Use multiple calculators and compare the results. Significant discrepancies should raise a red flag.

Verify Manually: Always cross-reference the calculator's output with your own manual calculations. This ensures greater accuracy.

Prioritize Reputable Sources: Stick to calculators from respected financial websites or government agencies.

Beyond the Basics: Financial Planning

Understanding your weekly income is the foundation of sound financial management.

Budgeting with Net Income: Budget using your net income (take-home pay), not your gross income.

Saving and Emergency Funds: Regular savings, even small amounts, are crucial for financial stability and handling unexpected expenses.

Long-Term Financial Goals: Plan for larger goals like retirement, homeownership, or education. Accurately understanding your income is essential for achieving these long-term financial objectives.

Key Takeaways:

- Manually calculating your weekly pay ensures accuracy, especially when dealing with variable hours or overtime.

- Online calculators can be useful tools but should be used cautiously and verified independently.

- Budgeting and planning for the future based on your net income is crucial for responsible financial management.